Bitcoin Sub $90k

BTC Selling Deepens

The sell-off in Bitcoin is deepening here with the futures market probing below the $90k-mark for the first time since April. Now down just shy of 30% from the record highs recorded at the start of last month, the correction lower is at risk of marking a shift into bear market territory, signalling risks of a deeper push lower. Price is now testing the bull channel lows which, if broken, will turn focus onto the $80,185 level just above the YTD lows.

Fed Easing Expectations Plunge

The sell-off comes amidst a shift in traders’ Fed outlook with December easing expectations having fallen sharply in recent weeks. The CME FedWatch tool now shows a less than 50% chance of a cut next month, down from around 95% pre-FOMC. With the roader risk complex coming under pressure, BTC has been heavily sold since early October, with growing ETF outflows driving the decline.

FOMC Mins & NFP

Looking ahead, focus will now be on the FOMC minutes due tomorrow followed by the release of delayed September labour market data on Thursday. If we hear a hawkish set of minutes and see fresh upside in the data, this could easily see BTC breaking down to YTD lows and beyond as traders further scale back Fed easing expectations. Alternatively, if Thursday’s data undershoots forecast, highlighting further weakness, this cold help BTC and other risk assets rebound as traders rebuild December easing expectations.

Technical Views

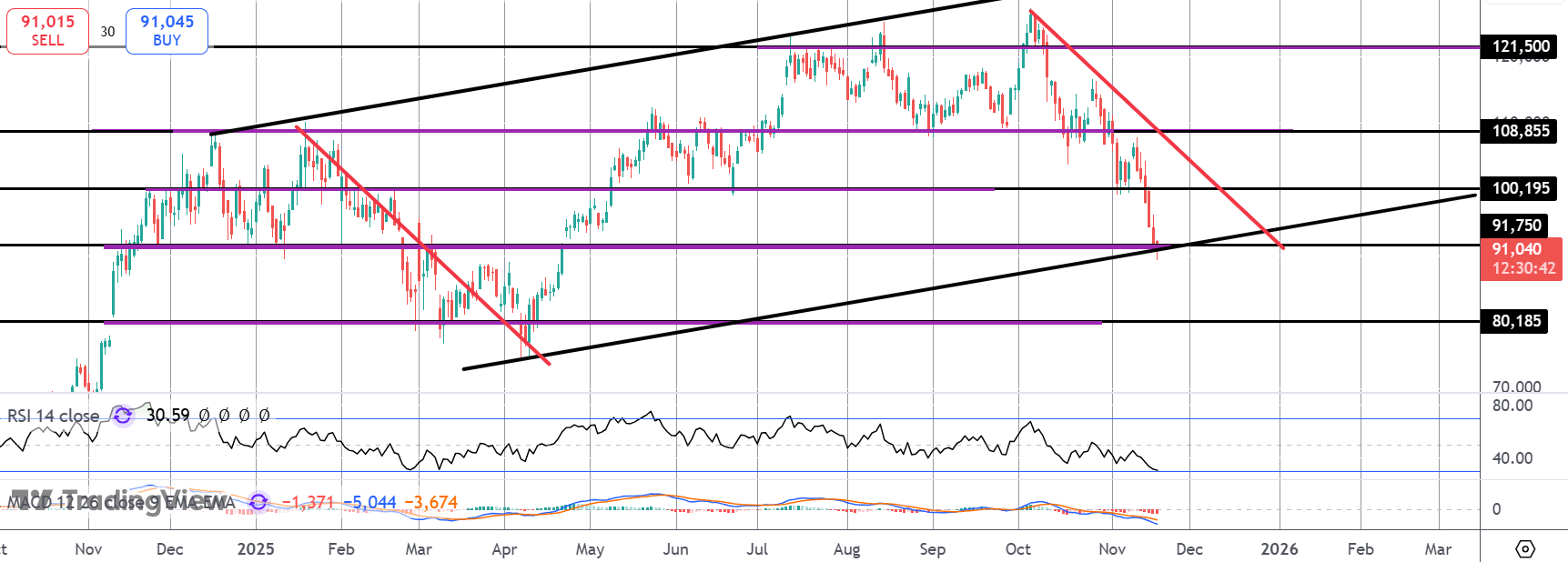

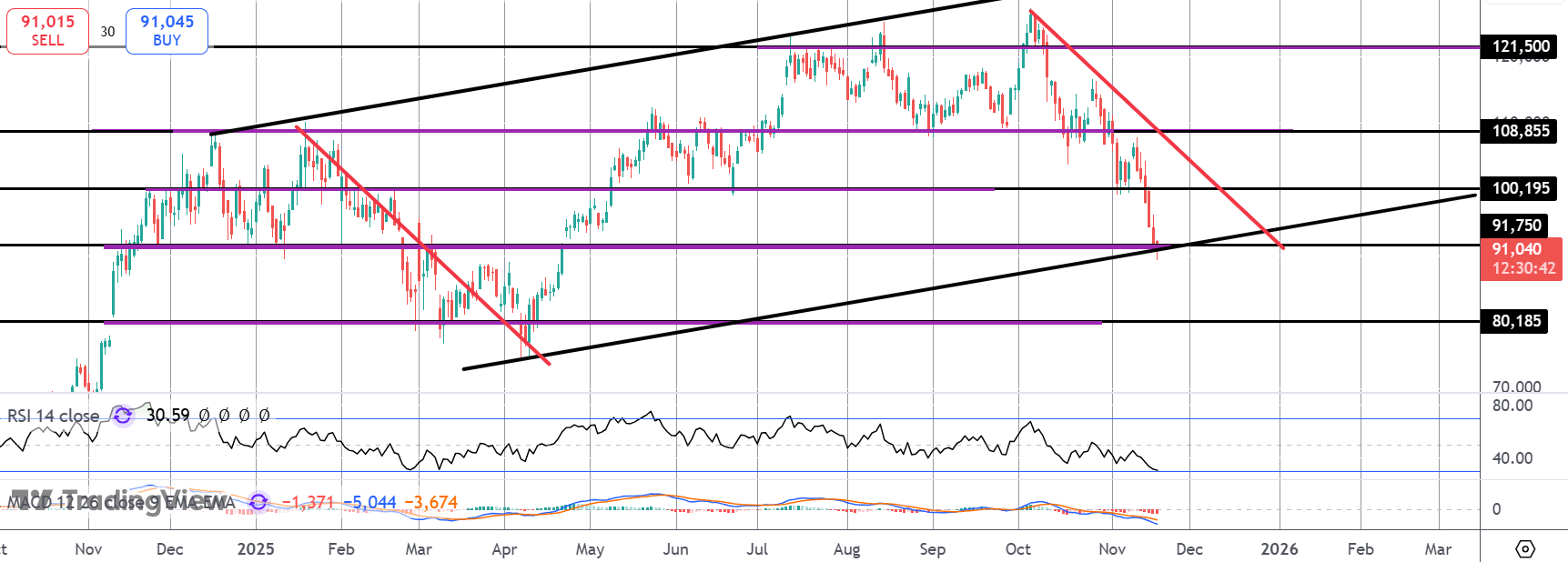

BTC

Bitcoin is now testing the bull channel lows, the $91,750 level support as well as the symmetry move with the Jan – Apr correction. This is an area of strong confluent support from which the market could rotate higher again within the channel. If we break lower here, however, a much deeper push is likely with $80,195 the first target for bears.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.