Crude Rallies on Russia Supply Risks

Ukraine Hits Russian Port

Crude prices have risen sharply today as traders respond to developments within the Russia-Ukraine war. News of a major drone attack on a key Russian oil port overnight shows that supply risk remains a key theme of the conflict with oil prices jumping accordingly. With the violence between the two countries showing no signs of slowing down and drone attacks intensifying, supply risks should continue to underpin prices particularly in response to news of any attacks on energy production and/or distribution infrastructure.

Oversupply Concerns

The rally in crude comes despite fresh concerns this week around oversupply risks and weak demand. In its latest outlook, the EIA upped its forecasts for 2025 supply levels which it now forecasts to set a new record, furtehr outstripping demand levels. This was echoed by the latest forecasts from OPEC this week too as it flagged oversupply risks early next year amidst weaker demand and recent output increases in OPEC countries.

Fresh EIA Inventories Increase

Adding to these concerns yesterday, the latest EIA data showed a sharp increase in US crude stores. Inventories surged to 6.4 million barrels, well above the 1-million-barrel surplus the market was looking for, extending the 5.2-million-barrel increase seen over the prior week. With crude stores rising heavily, reflecting weaker demand in the US, crude prices look unlikely to find too much upside momentum, particularly with growing economic uncertainty on the back of the US govt shutdown which came to an end this week.

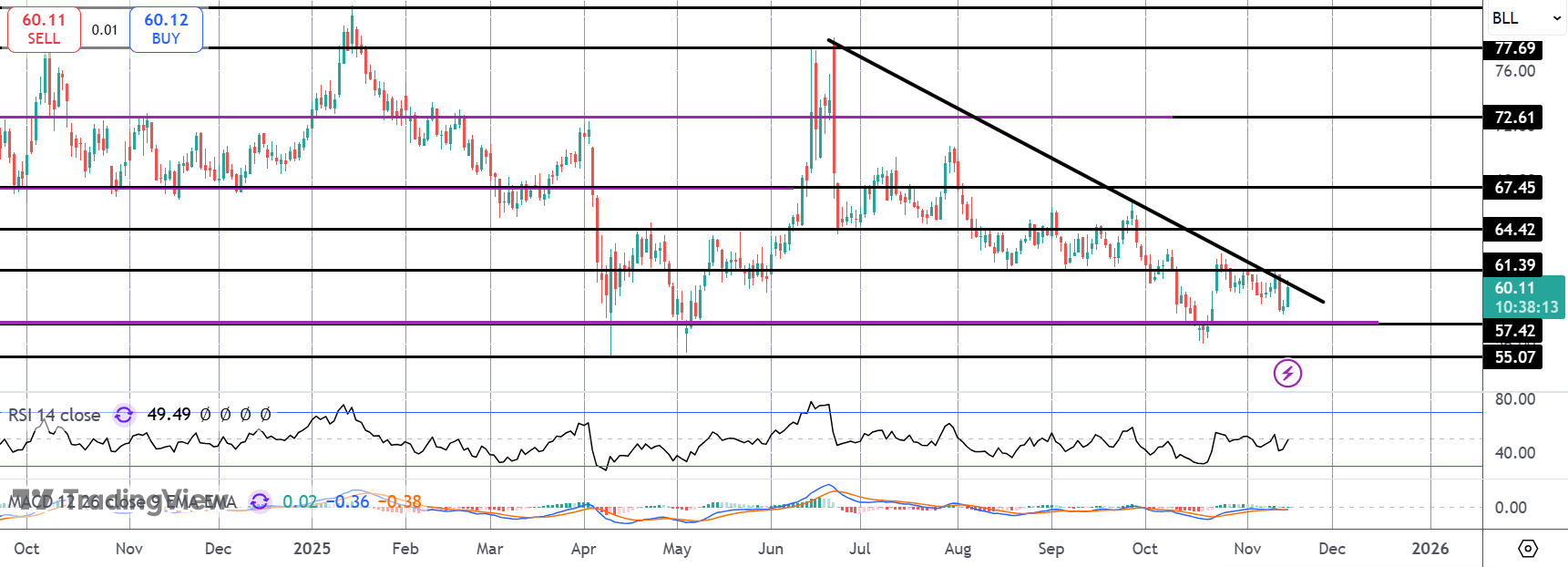

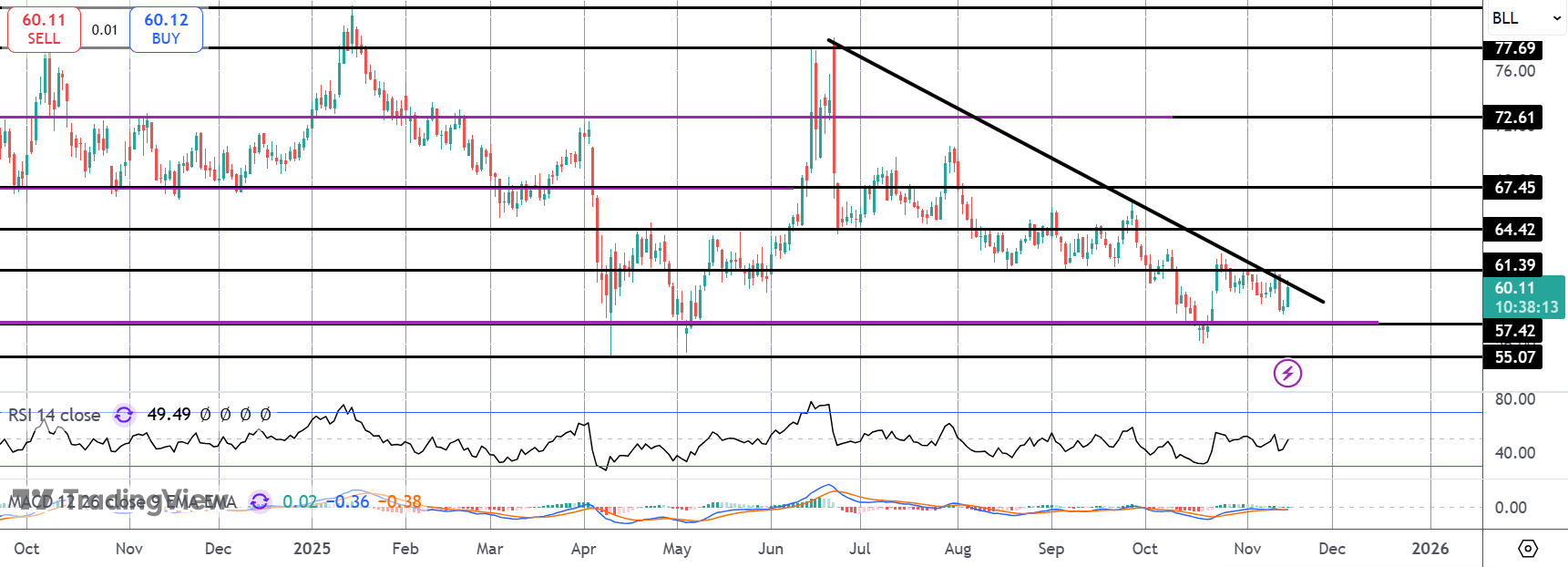

Technical Views

Crude

Crude prices are now once again testing the bearish trend line from summer highs with the 61.39 level sitting just above. This remains the key near-term marker. Below that level, risks of afresh test of YTD lows are seen. A break above there, however, turns focus to 64.42 and 67.45 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.