Intervention Risks in Focus As USDJPY Soars

USDJPY Rally Pushing Higher

USDJPY continues to push higher this week with the pair trading at 9 and a half month highs on Tuesday. The move comes amidst a downturn in Fed easing expectations which has had a heavy cross-market effect in recent weeks. With December easing probabilities now down below the 505 level from around 95% ahead of the October FOMC, traders have had to recalibrate across the board. Notably, despite the sell off we’ve seen in risk assets, JPY has bene unable to gain ground against USD which has reverted to being a stronger safe-haven destination in light of the shift in Fed outlook.

Fed Mins & NFP On Watch

Looking ahead this week, there is room for the rally to push even higher with the FOMC minutes due tomorrow followed by the delayed September NFP data on Thursday. The minutes are expected to be hawkish and should keep UDSD supported. However, Thursday’s data will be the key input to watch. Any upside surprise in the data will be firmly bullish for USD, seeing December easing expectations dropping even further. In this scenario, USDJPY could start to move closer to 160 at which point, intervention risks become extremely elevated. We’ve heard plenty of jawboning from Japanese officials over the last two months and with price now in the 155 – 160 band where we’ve seen intervention previously traders will be wary of further action, creating plenty of volatility risks near-term.

Technical Views

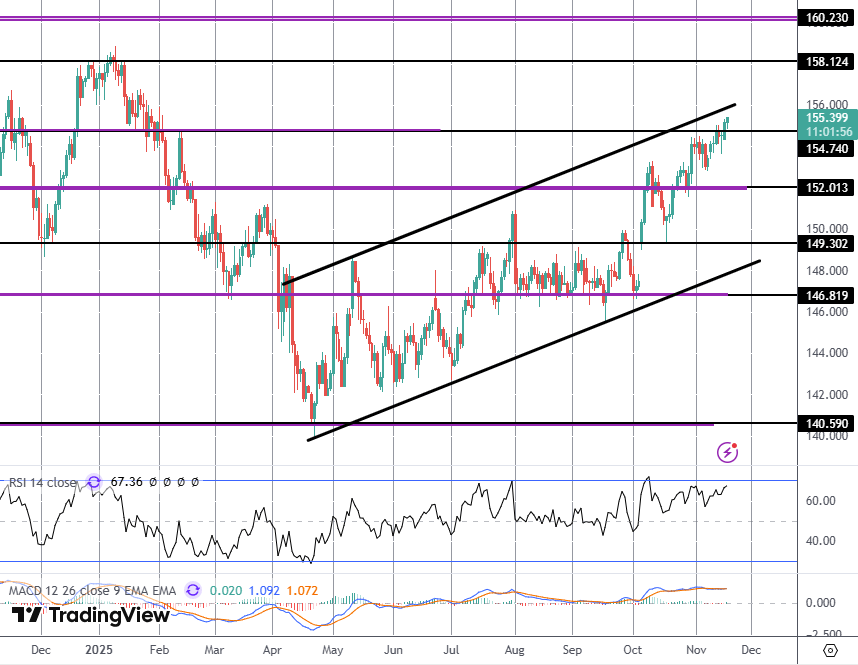

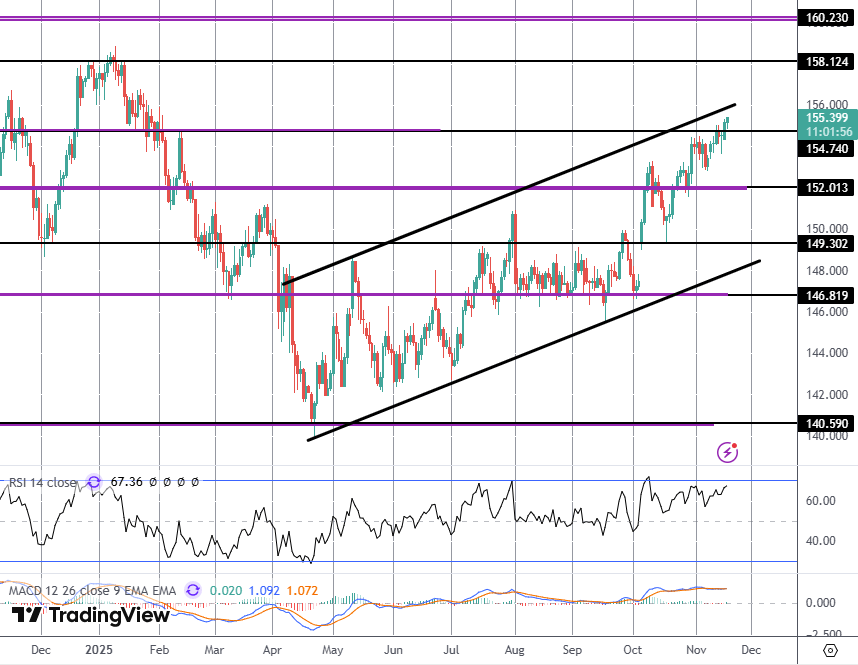

USDJPY

The rally in USDJPY has seen price breaking out above the 154.74 level. Now testing the bull channel highs. With bearish divergence in momentum studies, risks of a reversal are noted. However, while above the 154.74 level, focus is on a continuation towards the 158-level next with 160 above as the higher target. Any move below 154.74 will turn focus to 152 as next support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.